Turning $100 into $100,000 in crypto futures trading may sound like a fantasy—but with high leverage and smart strategy, it’s theoretically possible. One powerful tool that can help traders ride strong trends and avoid false signals is the ADX + DI (Average Directional Index + Directional Indicators) trend filter.

What is Crypto Futures Trading?

Crypto futures allow traders to speculate on the future price of cryptocurrencies like Bitcoin or Ethereum. Unlike spot trading, futures enable leveraged trading, where a small amount of capital controls a much larger position. With leverage of 100x, for example, $100 can open a $10,000 position. But remember, high reward comes with high risk—liquidation can happen quickly if the price moves against your trade.

Understanding the ADX + DI Indicator

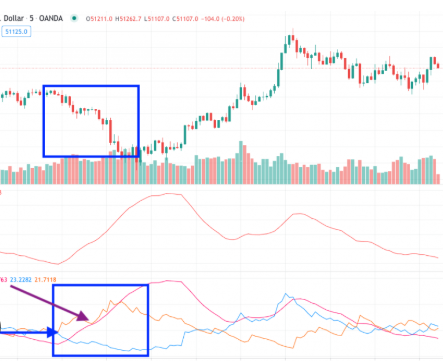

The ADX (Average Directional Index) is a technical analysis tool that measures the strength of a trend, regardless of direction. It is part of the DMI (Directional Movement Index) system, which includes:

- +DI (Positive Directional Indicator): Measures upward movement

- –DI (Negative Directional Indicator): Measures downward movement

- ADX: Measures the strength of the trend (not its direction)

When the ADX is above 20 or 25, the market is trending. If +DI > –DI, it indicates a strong uptrend. If –DI > +DI, it suggests a strong downtrend.

Strategy: Using ADX + DI for Entries

- Trend Confirmation: Wait for the ADX to cross above 20–25, signaling the start of a trend.

- Direction Filter:

- If +DI crosses above –DI → Look for long positions

- If –DI crosses above +DI → Look for short positions

- Entry Timing: Use candlestick patterns or support/resistance levels to fine-tune your entry.

- Risk Management: Always use a stop loss. For leveraged trades, risking 1–2% per trade is recommended.

- Compound Profits: Reinvest a portion of the profits to grow your account. This is key to turning $100 into larger sums.

Realistic Expectations

While it's technically possible to turn $100 into $100,000, it’s extremely difficult and requires:

- Consistent strategy execution

- Strong emotional discipline

- Solid risk management

- A bit of luck

Most traders lose money due to overleveraging or emotional decisions. The ADX + DI method helps reduce noise and improves trade quality by focusing on strong, directional moves.